Introduction

The manufacturing sector is pivotal in driving economic diversification, technological progress, and long-term competitiveness. Today, global value chains are more integrated and technology-driven, and the ability to advance in medium and high-tech manufacturing is essential for countries seeking sustainable growth. Reflecting this trend, the share of high-technology exports worldwide increased from 19.1% in 2014 to 22.9% in 2023, highlighting the growing role of technology in global trade. In middle-income countries, this indicator fluctuated between 21.1% and 24.4%, reaching its peak in 2020 but declining to 21.1% by 2023, which may indicate market saturation and a slowdown in technological modernization. The highest share of high-technology exports was recorded in upper-middle-income countries, where it peaked at 25.2% in 2020 and stood at 22.1% in 2023, potentially driven by increased production volumes in technologically advanced sectors.

Over the past two decades, emerging economies have demonstrated that industrial modernization, innovation-driven policies, and export-oriented growth strategies can significantly boost economic performance. Countries such as Georgia, Kazakhstan, Indonesia, the Philippines, and Vietnam have successfully leveraged industrial policies, foreign direct investment, and trade integration to develop their manufacturing sectors and increase the share of high-tech exports. Therefore, understanding these experiences is crucial for Uzbekistan in shaping policies that promote industrial upgrading, technological innovation, and export competitiveness.

Despite steady economic reforms and a growing focus on industrial development, Uzbekistan’s manufacturing sector remains concentrated in low- and medium-tech production, with limited integration into high-value global supply chains. Given the global shifts in medium and high-tech exports, it is imperative to assess the technological structure of Uzbekistan’s manufacturing sector, identify competitive advantages, and explore opportunities to increase the share of high-tech industries.

Hence, this analytical review provides a comprehensive national-level analysis of the manufacturing sector’s production and export technological structure in Uzbekistan from 2015 to 2023, benchmarking its performance against Georgia, Kazakhstan, Indonesia, the Philippines, and Vietnam. Further, this analysis delivers valuable insights into how Uzbekistan can enhance its manufacturing value-added, improve its export structure, and align with global best practices in industrial policy and economic development using a comparative approach with benchmark countries.

National Level Analysis

Between 2015 and 2023, Uzbekistan’s manufacturing industry experienced a notable transition in its technological composition. The analysis of the manufacturing industry's technological structure shows that since 2015, the combined share of high-tech and medium-high-tech sectors increased from 20.7% to 26.2%, mainly driven by an increase in the medium-high-tech industry. On the contrary, the share of the high-tech sector slightly decreased from 1.7% to 1.4% over the same period despite reaching a peak of 2.7% in 2021. Further structural analysis of the manufacturing sector in 2023 reveals that the pharmaceutical industry became the main contributor to the high-tech sector in Uzbekistan (51.4%), while the medium-high-tech sector was primarily driven by the chemical industry (24.5%) and machinery and equipment manufacturing (55.7%). Despite these improvements, a significant portion of Uzbekistan’s industrial production remained concentrated in medium-low-tech (37.5%) and low-tech (36.3%) sectors.

The manufacturing sector is pivotal in driving economic diversification, technological progress, and long-term competitiveness. Today, global value chains are more integrated and technology-driven, and the ability to advance in medium and high-tech manufacturing is essential for countries seeking sustainable growth. Reflecting this trend, the share of high-technology exports worldwide increased from 19.1% in 2014 to 22.9% in 2023, highlighting the growing role of technology in global trade. In middle-income countries, this indicator fluctuated between 21.1% and 24.4%, reaching its peak in 2020 but declining to 21.1% by 2023, which may indicate market saturation and a slowdown in technological modernization. The highest share of high-technology exports was recorded in upper-middle-income countries, where it peaked at 25.2% in 2020 and stood at 22.1% in 2023, potentially driven by increased production volumes in technologically advanced sectors.

Over the past two decades, emerging economies have demonstrated that industrial modernization, innovation-driven policies, and export-oriented growth strategies can significantly boost economic performance. Countries such as Georgia, Kazakhstan, Indonesia, the Philippines, and Vietnam have successfully leveraged industrial policies, foreign direct investment, and trade integration to develop their manufacturing sectors and increase the share of high-tech exports. Therefore, understanding these experiences is crucial for Uzbekistan in shaping policies that promote industrial upgrading, technological innovation, and export competitiveness.

Despite steady economic reforms and a growing focus on industrial development, Uzbekistan’s manufacturing sector remains concentrated in low- and medium-tech production, with limited integration into high-value global supply chains. Given the global shifts in medium and high-tech exports, it is imperative to assess the technological structure of Uzbekistan’s manufacturing sector, identify competitive advantages, and explore opportunities to increase the share of high-tech industries.

Hence, this analytical review provides a comprehensive national-level analysis of the manufacturing sector’s production and export technological structure in Uzbekistan from 2015 to 2023, benchmarking its performance against Georgia, Kazakhstan, Indonesia, the Philippines, and Vietnam. Further, this analysis delivers valuable insights into how Uzbekistan can enhance its manufacturing value-added, improve its export structure, and align with global best practices in industrial policy and economic development using a comparative approach with benchmark countries.

National Level Analysis

Between 2015 and 2023, Uzbekistan’s manufacturing industry experienced a notable transition in its technological composition. The analysis of the manufacturing industry's technological structure shows that since 2015, the combined share of high-tech and medium-high-tech sectors increased from 20.7% to 26.2%, mainly driven by an increase in the medium-high-tech industry. On the contrary, the share of the high-tech sector slightly decreased from 1.7% to 1.4% over the same period despite reaching a peak of 2.7% in 2021. Further structural analysis of the manufacturing sector in 2023 reveals that the pharmaceutical industry became the main contributor to the high-tech sector in Uzbekistan (51.4%), while the medium-high-tech sector was primarily driven by the chemical industry (24.5%) and machinery and equipment manufacturing (55.7%). Despite these improvements, a significant portion of Uzbekistan’s industrial production remained concentrated in medium-low-tech (37.5%) and low-tech (36.3%) sectors.

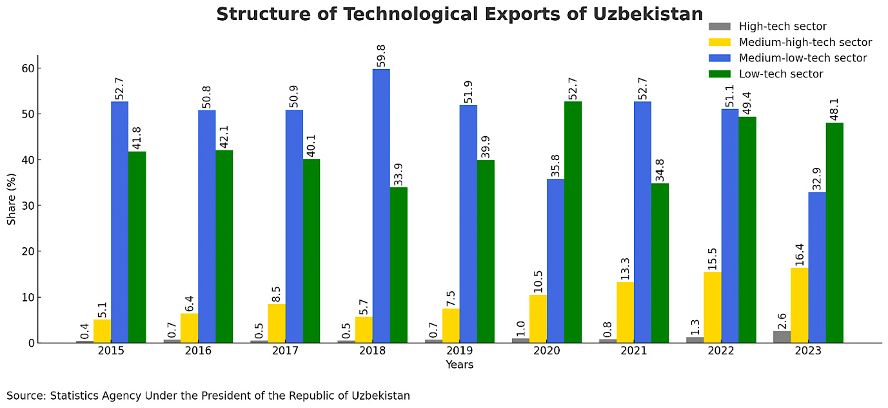

Uzbekistan’s export landscape underwent significant changes between 2015 and 2023. Technological exports in 2023 constituted 40.7% of the nation’s total exports, marking a decline of 13.1 percentage points from 53.8% in 2015. This shift suggests an increasing reliance on raw material exports. Further, a detailed breakdown of the technological export structure reveals that high-tech goods accounted for a mere 2.6% (1.1% of total exports), medium-high-tech goods comprised 16.4% (6.7% of total exports), medium-low-tech goods made up 32.9% (13.4% of total exports), and low-tech goods dominated with 48.1% (19.6% of total exports).

During 2023, total exports of Uzbekistan reached approximately $24.4 billion, reflecting a 23.8% increase from the previous year. Despite this growth, the substantial share of low and medium-low-tech goods indicates a continued dependence on less complex products. The decline in the share of high-tech exports, from 1.7% in 2015 to 1.1% in 2023, underscores challenges in advancing the high-tech sector. Conversely, the medium-high-tech sector experienced growth, rising from 19.0% to 24.8% over the same period, driven by industries such as chemicals and machinery manufacturing.

During 2023, total exports of Uzbekistan reached approximately $24.4 billion, reflecting a 23.8% increase from the previous year. Despite this growth, the substantial share of low and medium-low-tech goods indicates a continued dependence on less complex products. The decline in the share of high-tech exports, from 1.7% in 2015 to 1.1% in 2023, underscores challenges in advancing the high-tech sector. Conversely, the medium-high-tech sector experienced growth, rising from 19.0% to 24.8% over the same period, driven by industries such as chemicals and machinery manufacturing.

Comparative Analysis with Benchmark Countries (Philippines, Vietnam, Indonesia, Kazakhstan, Georgia)

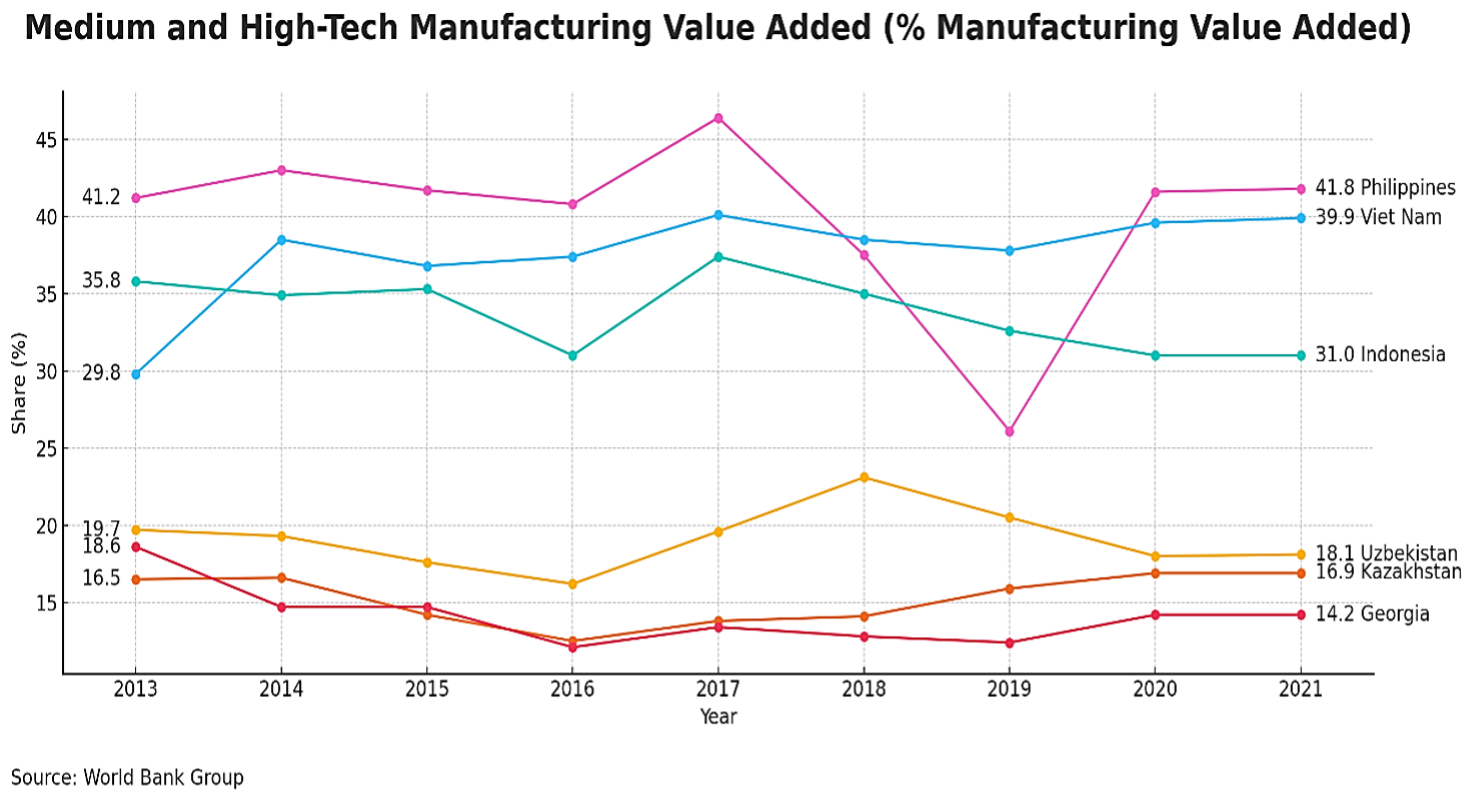

In comparative analysis with benchmark countries, between 2015 and 2021, Uzbekistan’s medium and high-tech manufacturing value-added experienced fluctuations, peaking at 23.1% in 2018 before stabilizing at 18.1% in 2021. This performance places Uzbekistan behind regional leaders such as the Philippines and Vietnam. The Philippines reached a high of 46.4% in 2017 and maintained 41.8% in 2021, while Vietnam saw consistent growth from 29.8% in 2013 to 39.9% in 2021. Indonesia also demonstrated a robust industrial base, with figures ranging between 31% and 37% during this period. Closer to Uzbekistan’s performance, Kazakhstan reported a 16.9% share, while Georgia stood at 14.2%, both showing minimal progress over the years. These figures position Uzbekistan in the mid-range among lower-performing countries, highlighting a significant gap compared to leaders like the Philippines and Vietnam.

In comparative analysis with benchmark countries, between 2015 and 2021, Uzbekistan’s medium and high-tech manufacturing value-added experienced fluctuations, peaking at 23.1% in 2018 before stabilizing at 18.1% in 2021. This performance places Uzbekistan behind regional leaders such as the Philippines and Vietnam. The Philippines reached a high of 46.4% in 2017 and maintained 41.8% in 2021, while Vietnam saw consistent growth from 29.8% in 2013 to 39.9% in 2021. Indonesia also demonstrated a robust industrial base, with figures ranging between 31% and 37% during this period. Closer to Uzbekistan’s performance, Kazakhstan reported a 16.9% share, while Georgia stood at 14.2%, both showing minimal progress over the years. These figures position Uzbekistan in the mid-range among lower-performing countries, highlighting a significant gap compared to leaders like the Philippines and Vietnam.

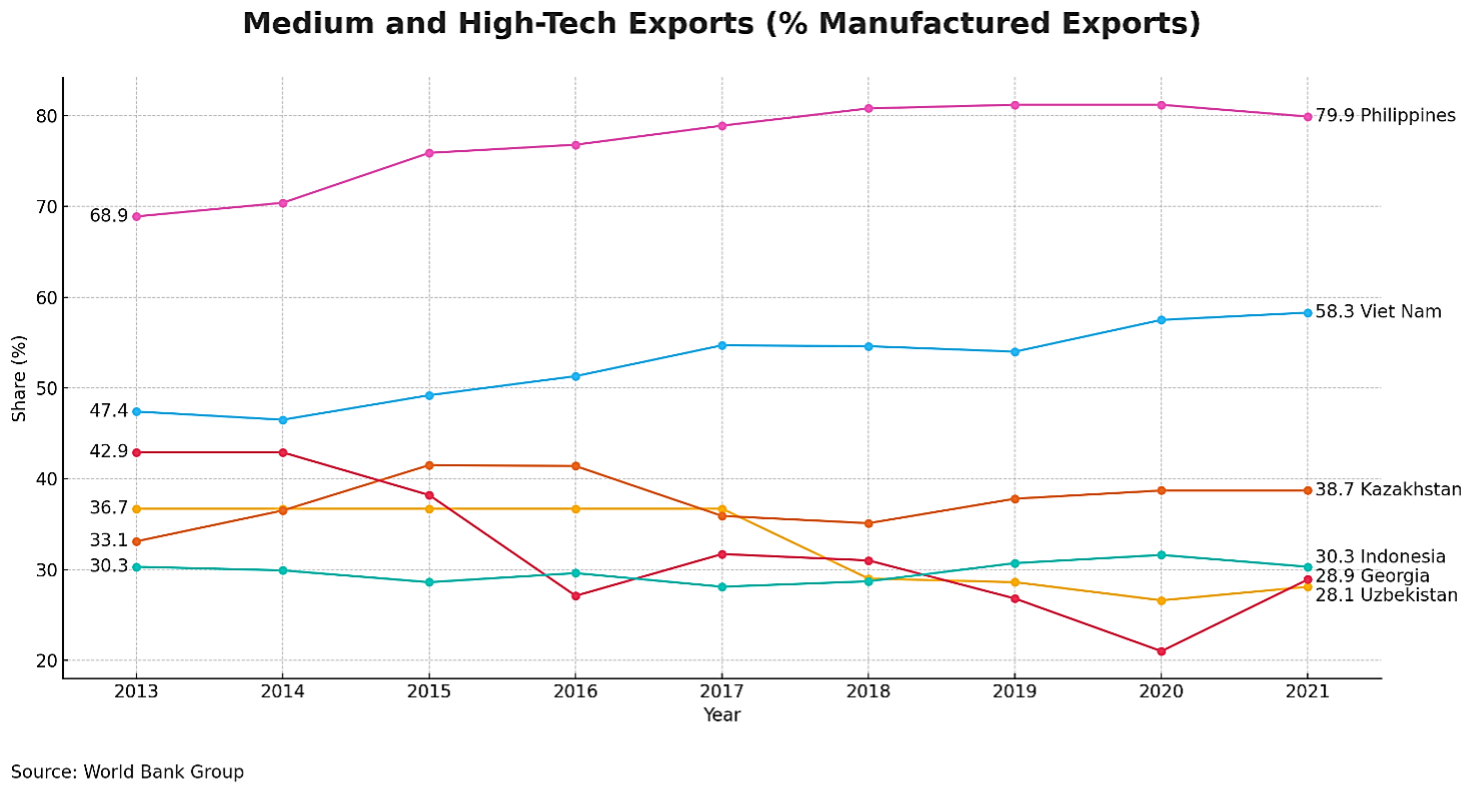

Between 2013 and 2021, the Philippines and Vietnam experienced the most significant growth in medium- and high-tech exports, with the Philippines increasing its share from 68.9% to 79.9% and Vietnam from 47.4% to 58.3%. Both countries have successfully prioritized high-tech industries, benefiting from strong FDI, innovation policies, and integration into global supply chains. In contrast, Indonesia maintained a relatively stable share of around 30%, with limited growth in high-tech exports, averaging only 9.5%. On the other hand, Kazakhstan and Georgia showed declining medium- and high-tech exports, with Georgia’s share dropping from 42.9% to 28.9%, although its high-tech exports saw slight growth.

Uzbekistan, however, experienced a significant decline in its medium—and high-tech export share, falling from 36.7% in 2013 to 28.1% in 2021. Despite this downturn, high-tech exports grew marginally from 1.5% to 2.8%, indicating some progress in advanced manufacturing. This decline in the broader technological export structure suggests the presence of structural challenges, including an overreliance on low-tech industries, weak innovation infrastructure, and limited integration into global value chains.

Uzbekistan, however, experienced a significant decline in its medium—and high-tech export share, falling from 36.7% in 2013 to 28.1% in 2021. Despite this downturn, high-tech exports grew marginally from 1.5% to 2.8%, indicating some progress in advanced manufacturing. This decline in the broader technological export structure suggests the presence of structural challenges, including an overreliance on low-tech industries, weak innovation infrastructure, and limited integration into global value chains.

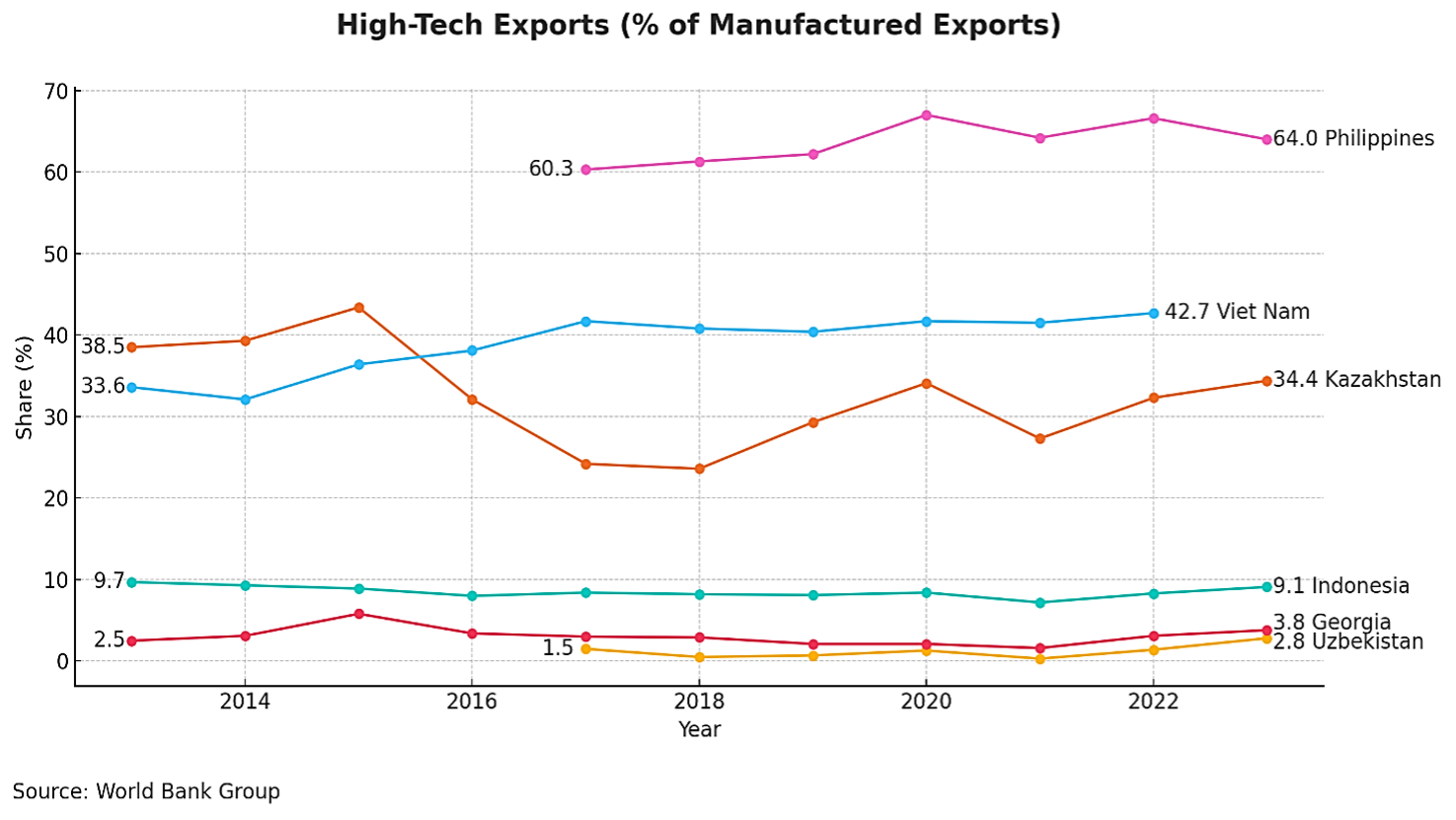

As per high-tech exports, Uzbekistan remains among the lowest within the benchmark countries, accounting for only 2.8% of manufactured exports in 2023, with minimal growth from 2.5% in 2013. Despite ongoing industrialization efforts, the stagnation of high-tech exports suggests that Uzbekistan has prioritized the development of other industries over high-value-added sectors such as advanced electronics, pharmaceuticals, and precision manufacturing in its export strategy. On the contrary, other developing countries such as the Philippines (64.0%) and Vietnam (42.7%) have successfully leveraged FDI, industrial policies, and integration into global supply chains to expand their high-tech sectors.

Despite slight improvements, Uzbekistan’s export structure remains dominated by low and medium-tech industries, reflecting limited R&D investment and/or weak advanced manufacturing capabilities. In contrast, Kazakhstan (34.4%), Indonesia (9.1%), and Georgia (3.8%) all maintain higher shares of high-tech exports. Nevertheless, data for Kazakhstan shows anomalies prior to 2017, where the share of high-tech exports exceeds that of medium- and high-tech exports. From 2017 onward, the data appears more consistent, but concerns about its reliability remain. In 2021, the share of medium- and high-tech exports stood at 38.7%, while high-tech exports accounted for 34.4%.

Despite slight improvements, Uzbekistan’s export structure remains dominated by low and medium-tech industries, reflecting limited R&D investment and/or weak advanced manufacturing capabilities. In contrast, Kazakhstan (34.4%), Indonesia (9.1%), and Georgia (3.8%) all maintain higher shares of high-tech exports. Nevertheless, data for Kazakhstan shows anomalies prior to 2017, where the share of high-tech exports exceeds that of medium- and high-tech exports. From 2017 onward, the data appears more consistent, but concerns about its reliability remain. In 2021, the share of medium- and high-tech exports stood at 38.7%, while high-tech exports accounted for 34.4%.

Conclusion

This analysis reviews the state of technological upgrading in Uzbekistan between 2015 and 2023 through manufacturing and international trade lenses. Since 2015, Uzbekistan’s manufacturing industry has gradually improved its technological structure, characterized by a growing share of the medium-high-tech sector and a declining reliance on low-tech production. Despite these advancements, Uzbekistan lags behind benchmark countries in technological development and manufacturing. Uzbekistan’s high-tech exports remain among the lowest compared to benchmark countries, accounting for only 2.8% of manufactured exports in 2023, with minimal growth from previous years. This slow growth highlights structural barriers, including low investment in R&D, insufficient industrial diversification, and limited integration into global value chains.

The comparative analysis with benchmark countries highlights that Uzbekistan still has a long way to go in developing its high-tech manufacturing sector. Meanwhile, countries like the Philippines (64.0%) and Vietnam (42.7%) have successfully expanded their high-tech exports by leveraging FDI, developing innovation-driven industrial policies, and enhancing workforce capabilities. This is also true for Kazakhstan (34.4%), Georgia (3.8%), and Indonesia (9.1%), which outperformed Uzbekistan in this area during the last decade. However, with targeted investments, policy reforms, and a stronger focus on innovation, Uzbekistan’s manufacturing industry has the potential for substantial transformation. Uzbekistan can gradually close the gap with its regional peers and position itself as a competitive player in global markets by prioritizing high-tech production, attracting FDI, and enhancing workforce capabilities.

The review of the present technological production landscape includes the following policy recommendations, which can strengthen medium—and high-tech industries in Uzbekistan and promote global competitiveness.

First, strengthening industrial and export policies can help increase the share of high-tech exports by incentivizing high-tech firms and domestic companies to scale up technology production. Aligning industrial policy with modern trends will help bridge technological gaps and drive industrial transformation. Besides, the structure of industrial investments should be reoriented toward high-tech and value-added industries by reallocating financial resources to advanced manufacturing sectors.

Second, Uzbekistan should strengthen investment protection laws to ensure the security of foreign and private investments in high-tech industries. This includes signing bilateral investment protection agreements with developed countries with a high share of high-tech exports, thereby increasing investor confidence and attracting capital into technology-intensive sectors.

Third, Uzbekistan must expand state support for research, development, and commercialization by establishing technology transfer and innovation networks. These networks should facilitate collaboration between academia, industry, and startups to accelerate the development and application of new technologies, ensuring that businesses can rapidly integrate innovations into production.

Fourth, the government should continue its active investment policy by focusing on priority projects that drive modernization, technological upgrades, and the establishment of new high-tech enterprises. This includes investing in advanced manufacturing capabilities in pharmaceuticals, electronics, and precision engineering, ensuring that “Made in Uzbekistan” high-tech products gain competitiveness in domestic and international markets.

Fifth, Uzbekistan should revitalize free economic zones and technology parks by actively attracting multinational technology firms to establish production facilities. Additionally, fostering strategic partnerships with global tech leaders in countries such as Germany, South Korea, and Japan will facilitate technology transfer, knowledge exchange, and integration into global supply chains. This also promotes the transition toward a knowledge-based, high-tech economy in Uzbekistan by strengthening international cooperation.

References

1. Statistics Agency under the President of the Republic of Uzbekistan. URL: https://stat.uz/en/

2. World Bank Open Data. URL: https://data.worldbank.org/

3. UN Comtrade Database. URL: https://comtradeplus.un.org/

Authors

Anton Kostyuchenko, Chief Specialist of the Project Office for the Promotion and Implementation of Green Economy, Graduate School of Business and Entrepreneurship under the Cabinet of Ministers of the Republic of Uzbekistan

Dr. Ikboljon Kasimov, Head of Research and Grants Department, Graduate School of Business and Entrepreneurship under the Cabinet of Ministers of the Republic of Uzbekistan

This analysis reviews the state of technological upgrading in Uzbekistan between 2015 and 2023 through manufacturing and international trade lenses. Since 2015, Uzbekistan’s manufacturing industry has gradually improved its technological structure, characterized by a growing share of the medium-high-tech sector and a declining reliance on low-tech production. Despite these advancements, Uzbekistan lags behind benchmark countries in technological development and manufacturing. Uzbekistan’s high-tech exports remain among the lowest compared to benchmark countries, accounting for only 2.8% of manufactured exports in 2023, with minimal growth from previous years. This slow growth highlights structural barriers, including low investment in R&D, insufficient industrial diversification, and limited integration into global value chains.

The comparative analysis with benchmark countries highlights that Uzbekistan still has a long way to go in developing its high-tech manufacturing sector. Meanwhile, countries like the Philippines (64.0%) and Vietnam (42.7%) have successfully expanded their high-tech exports by leveraging FDI, developing innovation-driven industrial policies, and enhancing workforce capabilities. This is also true for Kazakhstan (34.4%), Georgia (3.8%), and Indonesia (9.1%), which outperformed Uzbekistan in this area during the last decade. However, with targeted investments, policy reforms, and a stronger focus on innovation, Uzbekistan’s manufacturing industry has the potential for substantial transformation. Uzbekistan can gradually close the gap with its regional peers and position itself as a competitive player in global markets by prioritizing high-tech production, attracting FDI, and enhancing workforce capabilities.

The review of the present technological production landscape includes the following policy recommendations, which can strengthen medium—and high-tech industries in Uzbekistan and promote global competitiveness.

First, strengthening industrial and export policies can help increase the share of high-tech exports by incentivizing high-tech firms and domestic companies to scale up technology production. Aligning industrial policy with modern trends will help bridge technological gaps and drive industrial transformation. Besides, the structure of industrial investments should be reoriented toward high-tech and value-added industries by reallocating financial resources to advanced manufacturing sectors.

Second, Uzbekistan should strengthen investment protection laws to ensure the security of foreign and private investments in high-tech industries. This includes signing bilateral investment protection agreements with developed countries with a high share of high-tech exports, thereby increasing investor confidence and attracting capital into technology-intensive sectors.

Third, Uzbekistan must expand state support for research, development, and commercialization by establishing technology transfer and innovation networks. These networks should facilitate collaboration between academia, industry, and startups to accelerate the development and application of new technologies, ensuring that businesses can rapidly integrate innovations into production.

Fourth, the government should continue its active investment policy by focusing on priority projects that drive modernization, technological upgrades, and the establishment of new high-tech enterprises. This includes investing in advanced manufacturing capabilities in pharmaceuticals, electronics, and precision engineering, ensuring that “Made in Uzbekistan” high-tech products gain competitiveness in domestic and international markets.

Fifth, Uzbekistan should revitalize free economic zones and technology parks by actively attracting multinational technology firms to establish production facilities. Additionally, fostering strategic partnerships with global tech leaders in countries such as Germany, South Korea, and Japan will facilitate technology transfer, knowledge exchange, and integration into global supply chains. This also promotes the transition toward a knowledge-based, high-tech economy in Uzbekistan by strengthening international cooperation.

References

1. Statistics Agency under the President of the Republic of Uzbekistan. URL: https://stat.uz/en/

2. World Bank Open Data. URL: https://data.worldbank.org/

3. UN Comtrade Database. URL: https://comtradeplus.un.org/

Authors

Anton Kostyuchenko, Chief Specialist of the Project Office for the Promotion and Implementation of Green Economy, Graduate School of Business and Entrepreneurship under the Cabinet of Ministers of the Republic of Uzbekistan

Dr. Ikboljon Kasimov, Head of Research and Grants Department, Graduate School of Business and Entrepreneurship under the Cabinet of Ministers of the Republic of Uzbekistan